2024 Shareholder Proposal Highlights

The 2024 proxy season (July 1, 2023 – June 30, 2024) saw a continued increase in shareholder proposals in the US market, with Russell 3000 companies receiving 983 proposals, up from 929 in the prior year. Social proposals (416, compared to 421 in 2023) and environmental proposals (197, compared to 198 in 2023) were flat compared with the previous period, whereas governance proposals – including compensation – increased significantly (370, compared to 310 in 2023), driven by robust increases in traditional corporate governance proposals, particularly proposals related to the removal of supermajority provisions and director resignation bylaws. Governance proposals also recorded robust increased average shareholder support of 34%, compared to 29% in 2023. Environmental (18% support, compared to 21% in 2023) and social (15% support, compared to 18% in 2023) proposals both recorded lower support than in the prior season.

This alert highlights several notable developments in the most recent proxy season, including sector-specific trends and novel shareholder proponent tactics.

Sector trends

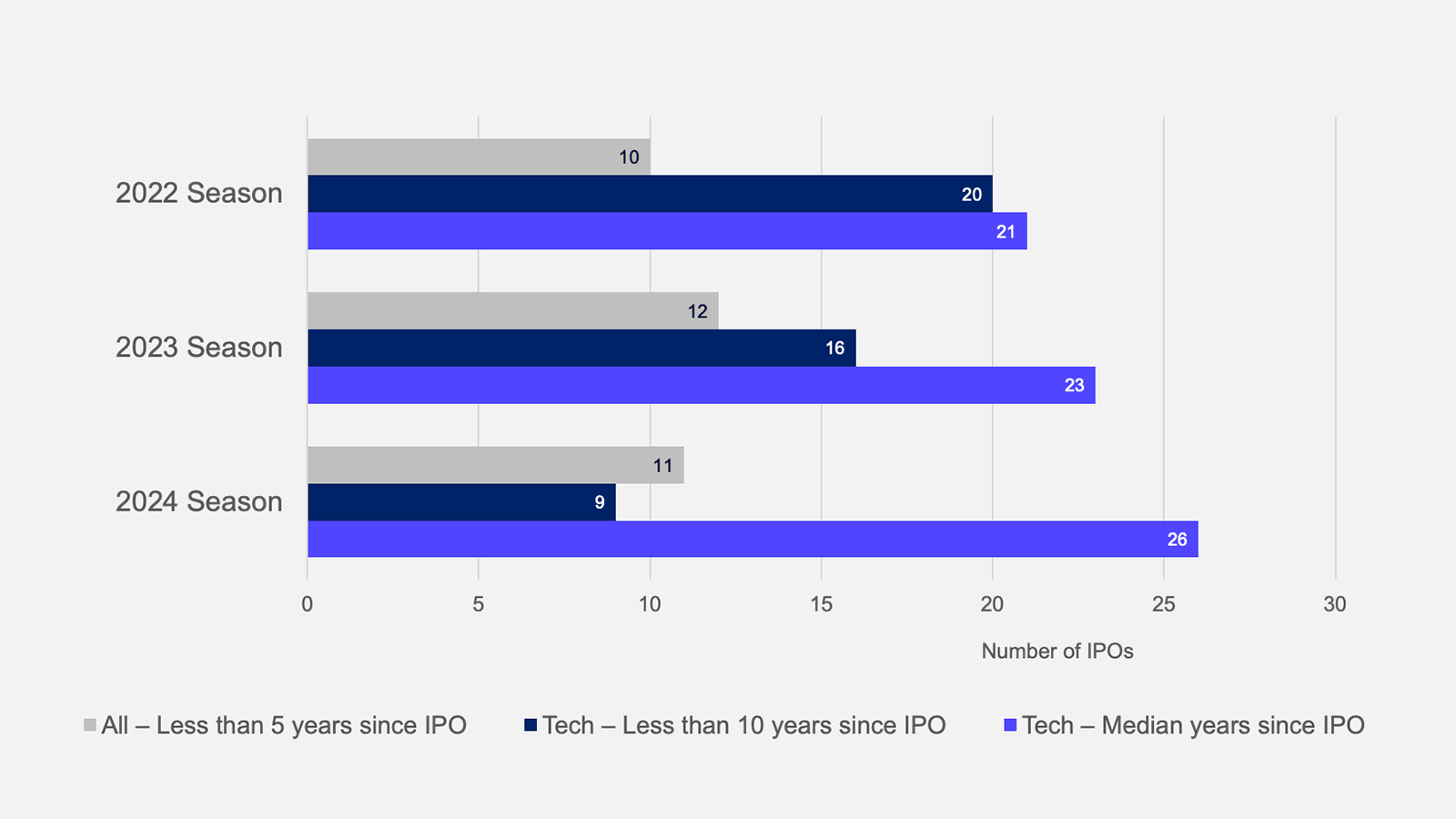

As in prior years, shareholder proposals in 2024 were heavily concentrated among larger-cap mature companies, with only 11 companies less than five years post-initial public offering (IPO) receiving proposals – compared to 12 in 2023 and 10 in 2022. For tech-sector companies1, the median shareholder proposal recipient was 26 years post-IPO, compared to 23 in 2023 and 21 in 2022. Only nine tech companies that went public in the last decade received shareholder proposals in the 2024 season, a decline from 16 in 2023 and 20 in 2022.

(Tech proposals by market cap)

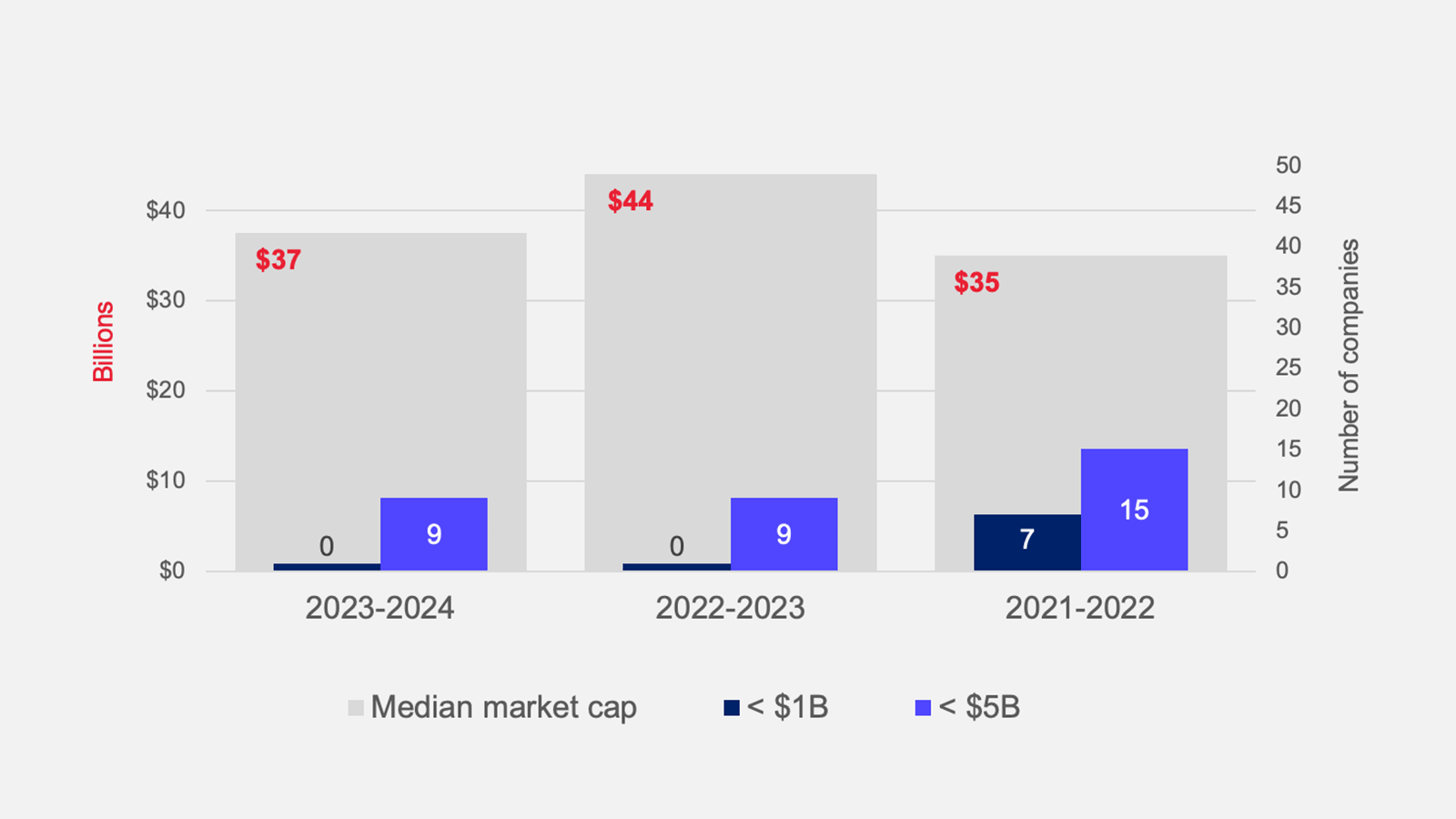

Tech-sector proposals remain focused on large-cap issuers, with a median market cap of $37 billion for proposal recipients in the 2024 season, compared to $44 billion in 2023 and $35 billion in 2022. As in 2023, no tech-sector companies under $1 billion received proposals, unlike in 2022, when proposals were submitted to five such companies. Mid-cap tech companies continue to receive a moderate number of proposals. In both 2024 and 2023, nine companies with a market cap under $5 billion received proposals, while in 2022, 15 such companies received proposals.

(Tech proposals by category)

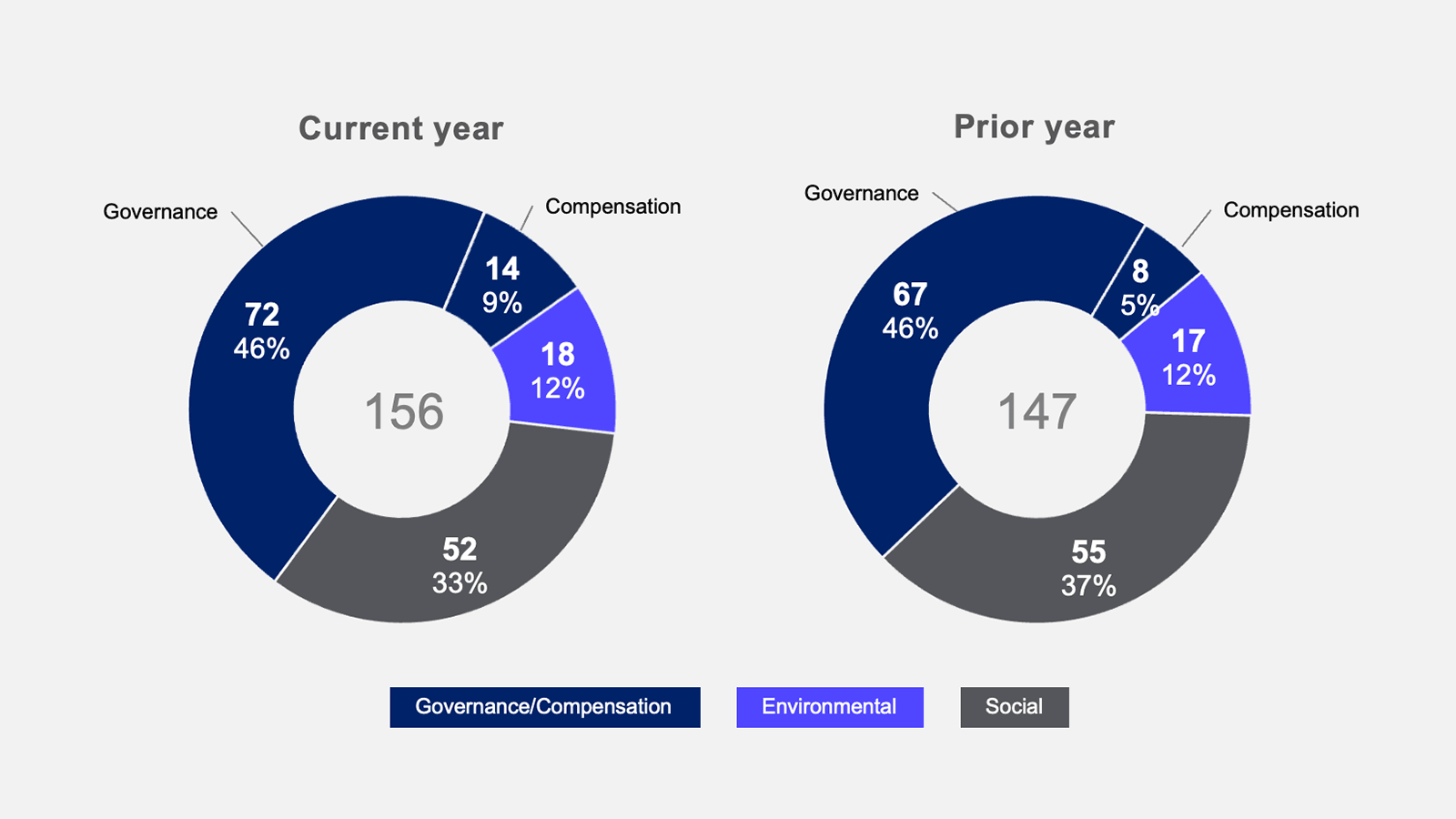

Consistent with the 2023 season, governance (46%) – including 11 simple majority vote proposals, nine special meeting right proposals, six director resignation bylaw proposals and four double-binding director compensation bylaw proposals (discussed below) – and compensation (9%) made up more than half of tech-sector proposals, compared to 46% and 5%, respectively, for 2023. Among tech companies, governance proposals also received the highest level of support at 36%, a significant increase from 22% in the prior year. Compensation proposals, on the other hand, saw support decreasing to 9.6% from 23.7%, though the sample size was relatively small (14 compensation proposals in 2024, compared to eight in 2023).

The percentage of governance and compensation proposals in the tech sector was significantly higher than in the Russell 3000 (38%), largely a function of the relatively low number of environmental proposals for tech sector companies, which remained flat with 2023 at 12%. Environmental proposals continued to receive only moderate support as well, increasing to 19.5% from 16.6% in 2023. The number of social proposals declined from 37% of all proposals in 2023 to 33% in 2024, and average support for social proposals also slightly declined, from 15.8% to 14.8% in the same period – though tech sector companies received seven proposals requesting reports regarding the use of, or risks related to, artificial intelligence, up from zero in the prior period. Top 2024 social proposals included viewpoint discrimination proposals from anti-ESG (environmental, social and governance) proponents and traditional human rights, diversity and pay gap matters.

(Life sciences proposals by market cap)

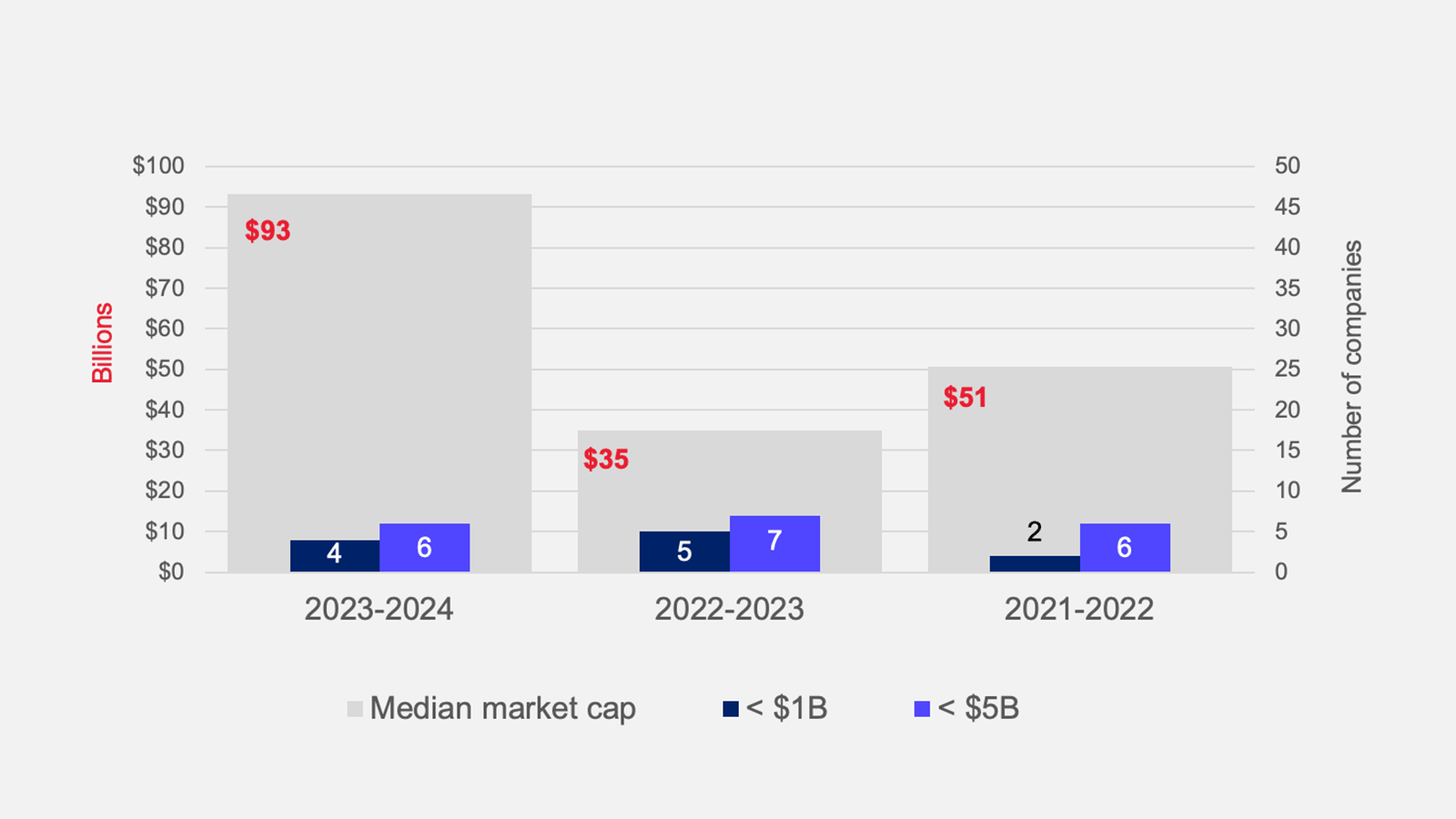

Overall trends in the life sciences industry are broadly consistent with the tech sector. Proposals are heavily concentrated among large-cap issuers, with 2024 witnessing a significant increase in the median market cap of proposal recipients, rising to $93 billion from $35 billion in 2023 and $51 billion in 2022. A limited number of smaller-cap companies continue to receive proposals, with six companies under $5 billion (four under $1 billion) receiving proposals in 2024, compared to seven in 2023 (five under $1 billion) and six in 2022 (two under $1 billion).

(Life sciences proposals by category)

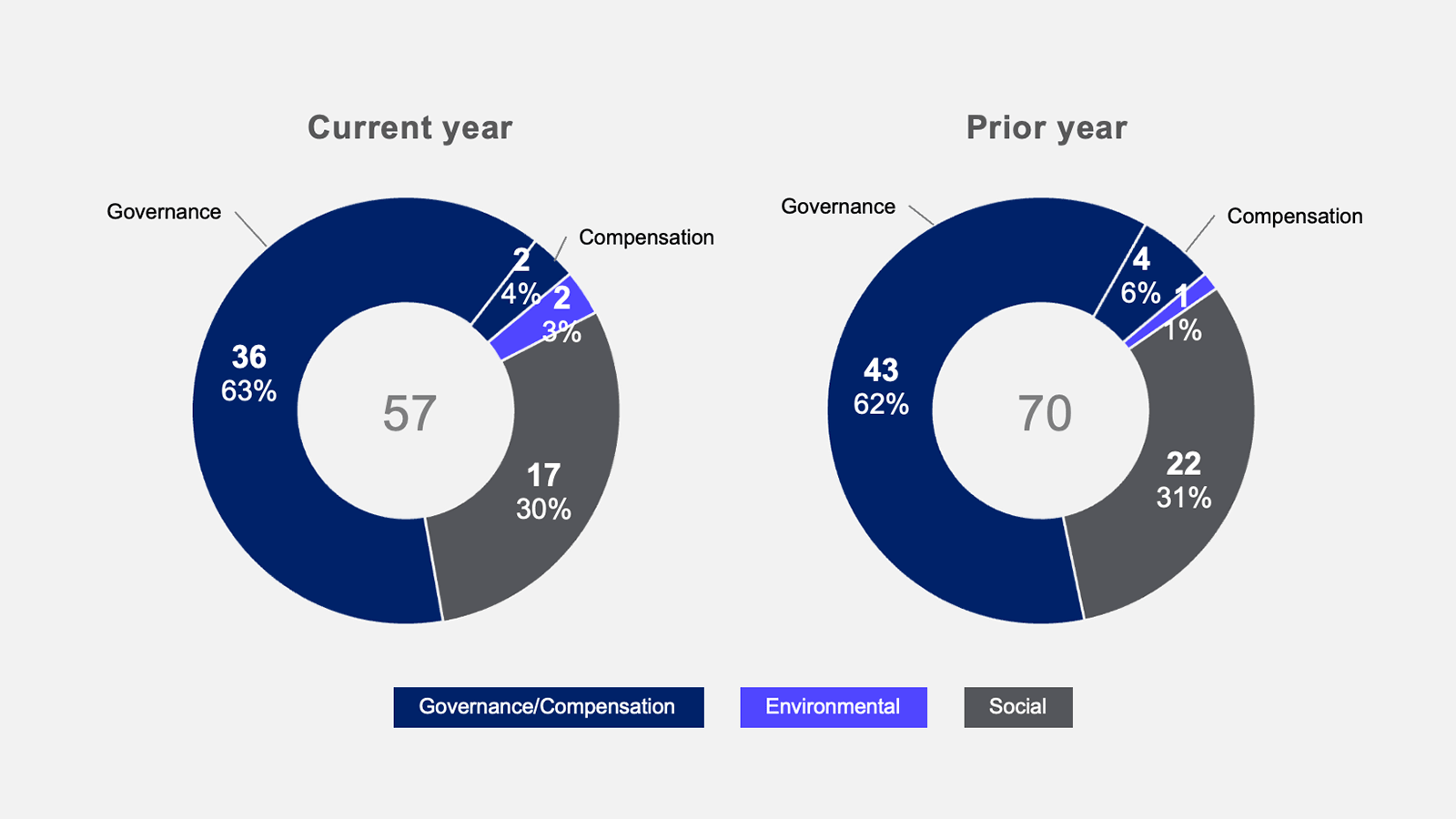

Life sciences companies received approximately 60% fewer proposals than tech companies, with only 57 proposals in the 2024 season, a 19% decline from the prior year. Even more than in the tech sector, proposals were dominated by governance and compensation – together making up two-thirds of all life sciences proposals, particularly traditional governance proposals, where average support rose from 30% to 38%. Social proposals decreased slightly from 31% to 30%, with average support falling from 18% to 13%. Consistent with previous years, social proposals included a broad mix of generally applicable topics, such as human rights and racial equity audits, and industry-specific topics, particularly, patient access and intellectual property issues. As in 2023, environmental and compensation proposals were in the low single digits.

Climate change

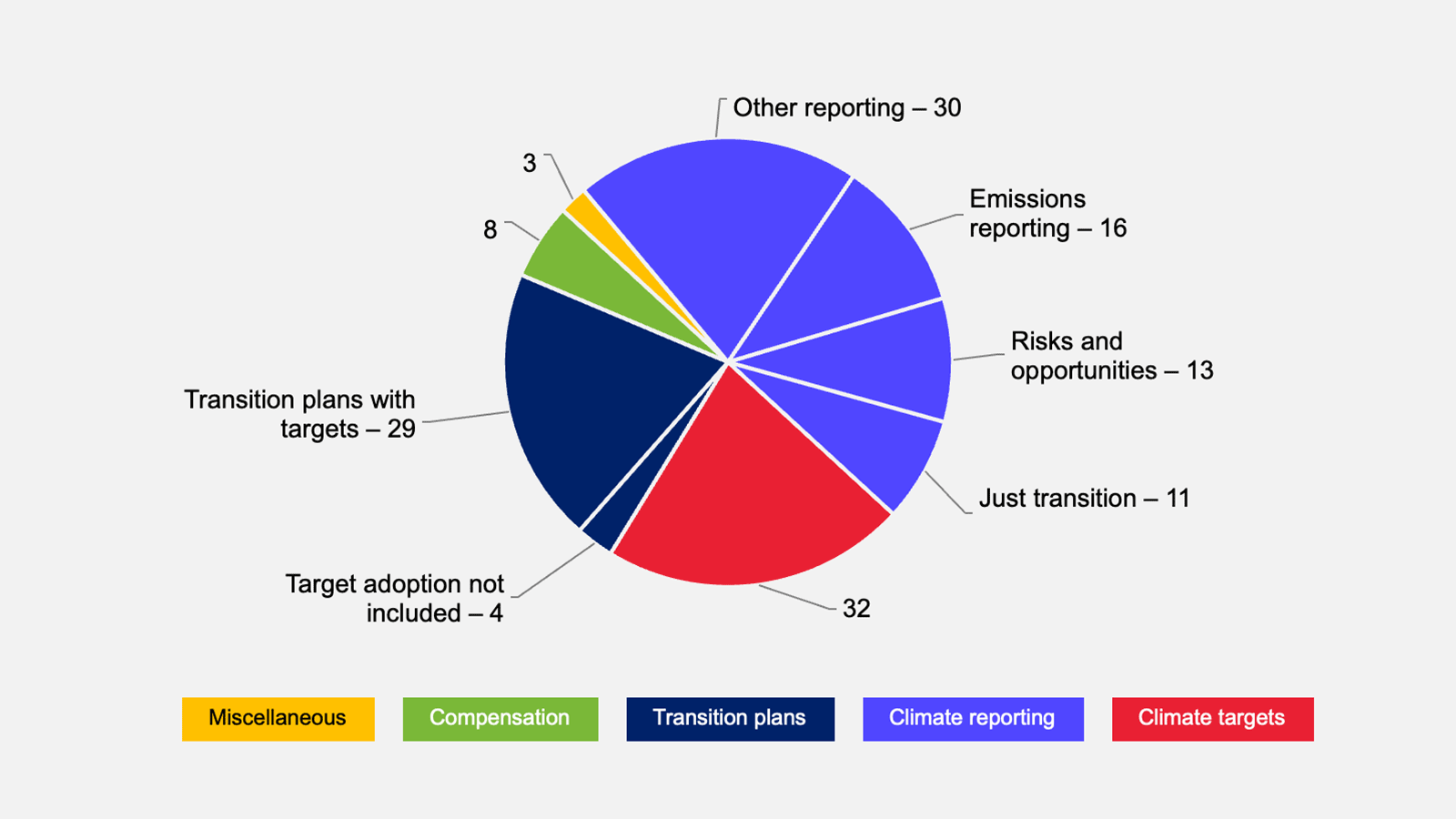

As in prior years, climate-related proposals constituted the overwhelming majority of environmental proposals, with 146 received in the 2024 season, representing a slight decline from 151 in 2023. Climate proposals remained highly diverse and often were multifocused, such as proposals requesting both climate reporting and target setting, or adopting targets in connection with establishing transition plans. As in the past, proposals primarily focused on pushing companies to adopt climate-related disclosures were the largest subset of climate proposals, representing nearly half in 2024 with 70 proposals, up from 58 in 2023. Such proposals included requests for risk and opportunity disclosures (13 in 2024, up from 10 in 2023), emissions disclosure requests, particularly with regard to Scope 3 emissions (16 in both 2024 and 2023), and disclosures regarding “just transition” impacts (11 in 2024, up from eight in 2023). The largest share of climate reporting proposals (30 in 2024, up from 24 in 2023) continued to fall into the “other” category, primarily consisting of industry-specific requests, such as reports on climate financing or proxy voting practices, as well as reports on climate-related lobbying. Proposals requesting the adoption of emissions reduction targets (32 in 2024, down from 38 in 2023) and climate transition plans (33 in 2024, down from 35 in 2023) together continued to make up nearly all other climate-related proposals. Notably, transition plan-focused proposals also included emissions target requests in all but four cases in 2024 and all but one case in 2023. Compensation-related proposals (eight in 2024, up from four in 2023) and miscellaneous other proposals – including requests for climate-related divestments (three in 2024, down from 16 in 2023) – constituted the remainder of climate proposals.

(Climate proposals by category)

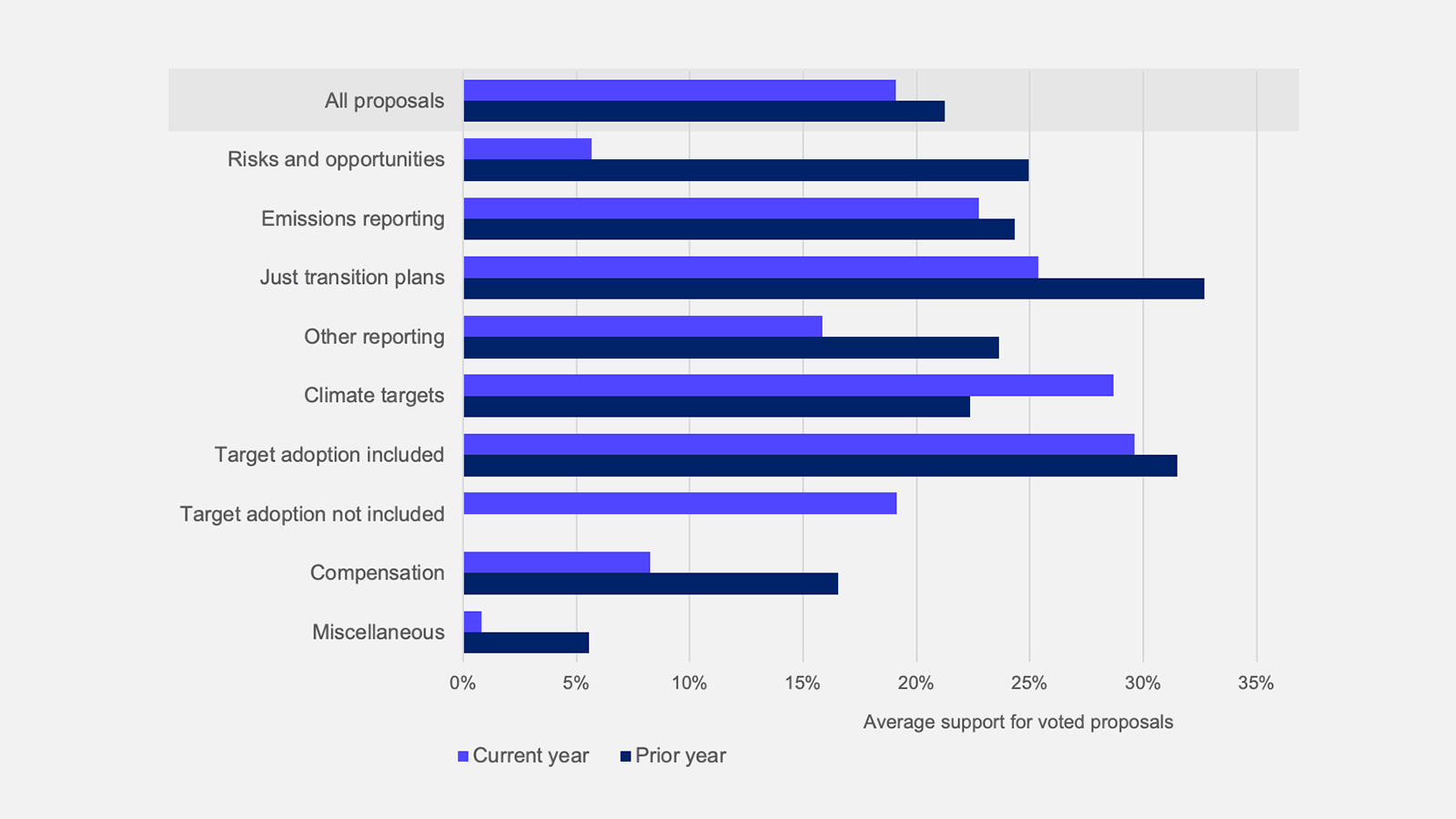

Average support for voted climate proposals declined slightly to 19% in the 2024 season, down from 21% in the prior year. Climate-reporting proposals contributed most to the overall decline in support, with voted proposals receiving average support of 16% in 2024, down from 24% in the prior period.

(Climate proposal average support by subcategory)

Evolving shareholder proposal tactics

Double-binding bylaw proposals

As in previous years, the lion’s share of 2024 governance shareholder proposals related to requested amendments to bylaws or charters, with 213 such proposals representing a 46% increase from 145 proposals in 2023. Non-binding (precatory) simple majority vote proposals requesting the removal of bylaw or charter supermajority provisions represented the largest share of such proposals at 55, a significant increase from only 18 such proposals in the prior year. Already extremely robust average support for voted proposals increased further from 55% in 2023 to 71% in 2024. Other top bylaw and charter amendment proposals also were precatory, including 46 requests to adopt director resignation bylaws, up from only six in 2023, and shareholder special meeting right proposals, which declined from 50 in 2023 to 35 in 2024.

While precatory proposals requesting governance document amendments continued to dominate, a notable trend in 2024 was the submission of at least 15 binding bylaw proposals. Such proposals would directly amend a company’s bylaws upon receiving requisite shareholder support. Thirteen of these were so-called double-binding proposals developed by Michael Levin of the Activist Investor, ostensibly motivated by recent Delaware litigation regarding Tesla director compensation and submitted by John Chevedden. These proposals aimed to directly amend company bylaws to require annual binding (thus the “double” bind) shareholder votes to approve director compensation. Five of these double-binding proposal recipients sought and received no-action relief from the staff of the Securities and Exchange Commission on the grounds that the proposals violated state law, and another recipient received relief on micromanagement grounds. The seven other proposals were voted on and received uniformly low support (approximately 2%) and negative proxy adviser recommendations. At least two other binding bylaw proposals were submitted and voted in 2024, one that would have created a bylaw requirement for an independent board chair (11% support) and another that would have amended a company’s bylaws to waive the business judgement rule in duty of care or loyalty actions relating to political or ideological matters (less than 1% support).

Although binding bylaw proposals received very low support in 2024, governance proposals more broadly, however, consistently received robust support and included all but two of the shareholder proposals passing in 2024. While limited receptiveness to recent binding proposals may be partially driven by general skepticism of nonprecatory approaches, the specific content of the proposed amendments also likely was a key factor. As a result, companies should not necessarily expect similarly low support for binding bylaw proposals on more popular governance topics, such as independent board chairs (the one example that in 2024 performed notably better than other binding proposals) and majority director election standards. The uptick in binding bylaw proposals highlights the importance of ongoing vigilance in reviewing proposals for procedural deficiencies and considering substantive bases for exclusion with counsel. Companies also should consider proactively engaging with institutional shareholders to identify structural governance concerns on their own terms.

Universal proxy strategy

Another novel shareholder proponent tactic in 2024 leveraged the new universal proxy system to conduct an end-around the Rule 14a-8 shareholder proposal regime. The AFL-CIO and United Mine Workers of America submitted five proposals on their own proxy materials to Warrior Met Coal’s shareholders under the company’s advance notice bylaws, rather than pursuant to Rule 14a-8. By doing so, the proponents were exempt from the restrictions of Rule 14a-8, including those regarding the number, subject matter and content of proposals. While such an approach has always been available to activists and other shareholder proponents in the past, the Warrior Met Coal proponents were able to include the company’s full director slate in their proxy materials without having to solicit for their own nominees by relying on the universal proxy-related amendments to Rule 14a-4(d) that allow the solicitation of votes for director nominees without such party’s consent. The inclusion of the company’s full director slate on the proponents’ proxy card increased the likelihood that shareholders would vote the proponents’ proxy card. This strategy effectively compelled the company to include the shareholder proposals in its proxy materials to encourage the use of the company’s proxy card in order to solicit votes against the proposals and to have timely visibility into quorum satisfaction. Ultimately, two of the shareholder proposals (requesting poison pill shareholder approval and proxy access bylaws) received majority support, while a third proposal requesting a labor rights report received 46% support.

While the binding bylaw trend and the Warrior Met Coal case both point to continuing shareholder proponent creativity, the latter tactic is likely more immediately threatening to companies. For companies, like Warrior Met Coal, subject to ongoing union or other stakeholder activist negotiations, the threat of receiving a potentially unlimited number of proposals that cannot be excluded pursuant to Rule 14a-8 represents an unwelcome novel pressure tactic. Potential adoption of this strategy by climate activists or anti-ESG proponents who are willing to bear the additional solicitation costs could be a powerful tool to draw attention and negotiate concessions from priority companies. In addition, activist investors engaged in a proxy contest could also utilize the tactic to increase the likelihood of a company settlement in order to avoid having to address not only a competing director slate but also multiple unregulated shareholder proposals. A recent uptick in litigation challenging the enforceability of advance notice bylaws has caused many companies to consider removing more aggressive provisions; however, such provisions continue to provide important protections against proposals outside of Rule 14a-8 and may take on renewed relevance following the Warrior Met Coal campaign.

Note

- For purposes of this alert, "tech" includes core hardware, software and computing companies, as well as web-focused businesses in retail, transportation, business services and other industries, such as ride-share, e-commerce and FinTech companies. This alert was updated on August 22, 2024 to include additional such companies in the tech sector pool.

Related Contacts

This content is provided for general informational purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Cooley LLP, Cooley (UK) LLP, or any other affiliated practice or entity (collectively referred to as "Cooley"). By accessing this content, you agree that the information provided does not constitute legal or other professional advice. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction, and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Do not send any confidential information to Cooley, as we do not have any duty to keep any information you provide to us confidential. When advising companies, our attorney-client relationship is with the company, not with any individual. This content may have been generated with the assistance of artificial intelligence (Al) in accordance with our Al Principles, may be considered Attorney Advertising and is subject to our legal notices.