Insights From Early Adopters of EU’s Corporate Sustainability Reporting Directive

New mandatory sustainability reporting obligations under the European Union’s Corporate Sustainability Reporting Directive (CSRD) are looming large on the horizon for EU and non-EU companies alike. The first wave of companies required to report to the CSRD will need to report to the European Sustainability Reporting Standards (ESRS) as early as 2025 in respect of their fiscal year 2024.

Already, in advance of their legal requirement, companies are reformulating their sustainability disclosures to more closely resemble the methodology, content and format requirements of the CSRD. While none of the reports we have seen are 100% aligned with the CSRD – in fact, most often, companies disclose that they are only partially aligned – they provide some useful insights into what CSRD reporting will look like.

We’ve dug into 20 of these reports, all but three of which were integrated annual reports, as opposed to stand-alone sustainability reports, for companies representing a range of industries, including food and beverages, automobiles, software and IT, healthcare and pharmaceuticals, chemicals, and packaging. However, most are companies headquartered in the EU, primarily northern Europe (six Danish, three Finnish, two Belgian, two Dutch, one Swedish and one Czech), with one US and one Swiss domiciled, and two Norwegian companies considered. It should be noted that many of these entities already will have been subject to some level of sustainability disclosure under EU regimes such as the Non-Financial Reporting Directive and national laws requiring some level of supply chain due diligence and disclosure. US companies, even large-cap companies with extensive voluntary disclosures, are likely to experience a greater shift in how they manage and disclose sustainability-related impacts, risks, and opportunities.

| General statistics | |

| Average number of pages | 90 |

| Longest number of pages | 209 |

| Average year-over-year page increase | 32% |

Assurance:

|

|

Takeaways of note

As compliance with the CSRD is not mandatory for any of the companies reporting, the degree of alignment with the CSRD and related ESRS varies considerably. However, these initial examples show some notable trends, as outlined below.

Sustainability matrices are not the only way to present the outcomes of a double materiality assessment. While the matrix plotting risks/opportunities on one axis and company impact on the other remained common, its use was not universal. Such matrixes already are quite common in voluntary sustainability reporting, though they are disfavored by some companies, particularly due to concerns that they lend themselves to misleading interpretations.

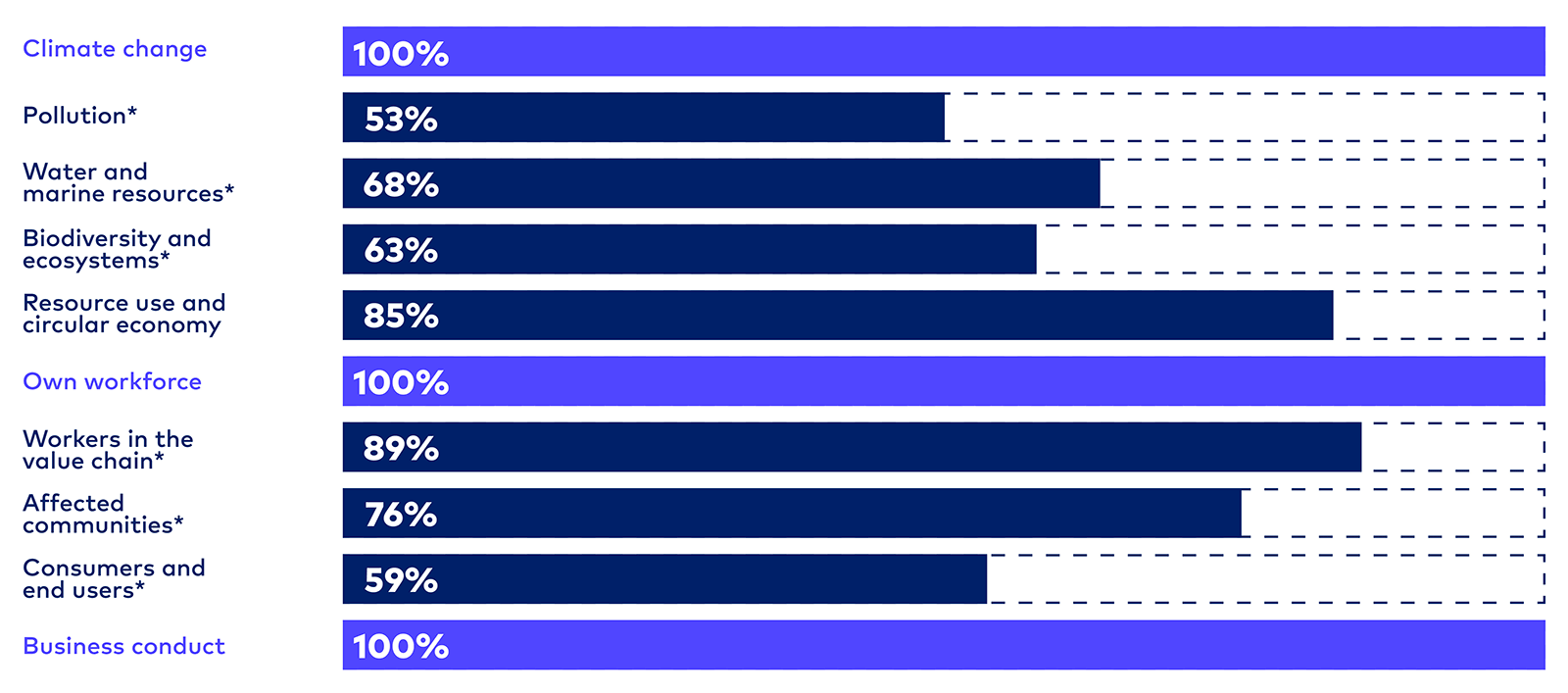

Climate (E1), own workforce (S1) and business conduct (G1) were material for all companies, while other sustainability topics saw greater variance in their materiality determinations. This variance is symptomatic of both the industries represented by the reports and the level of alignment to the CSRD (e.g., certain topics and datapoints within topics marked with an asterisk below were not addressed at all by some companies).

Scope 3 greenhouse gas emissions were universally disclosed. Companies also shifted or made clearer their alignment to the “operational control” approach required for emissions accounting under the ESRS.

Half of the reports reviewed included additional entity-specific topics. In addition to disclosing against the topical ESRS standards, entity-specific disclosures are required when the material sustainability matter is not covered by an ESRS or is not covered with sufficient granularity. Cybersecurity, data privacy and product safety, including the safe integration of artificial intelligence, were among the more common entity-specific topics identified as material, while those in the food and beverage industry focused on animal welfare and food safety.

On July 26, 2024, the European sustainability standards body, EFRAG, released a report on observed practices from 28 selected companies representing eight industries providing further takeaways, which are likely to be of interest to those starting out on their CSRD journey.

A significant shift in approaches to materiality toward an objective, evidence-based approach. In previous years, companies reporting on sustainability information largely have focused on impact through the Global Reporting Initiative (GRI), or financial materiality through the Sustainability Accounting Standards Board (SASB) sustainability standards. These processes mainly use judgment-based inputs. By contrast, of those surveyed by EFRAG, approximately 70% were pursuing an objective, evidence-based approach relying mainly on internal and third-party data that is complemented, mainly where data is not available, by the judgment of internal experts and stakeholders. When assessing financial materiality, about 80% leveraged the thresholds commonly used for company risk management.

Stakeholder engagement is critical to the double materiality process, but surveys alone are not the answer. EFRAG reported that surveys were useful in combination with interviews and workshops, but it also noted that respondents considered surveys alone to be a poor engagement channel, as they often result in inconclusive output or insufficient stakeholder expertise. Instead, EFRAG noted that 70% ran interviews to ascertain in-depth views on priority sustainability topics, and that workshops were an increasingly preferred engagement channel for reviewing a double materiality assessment, with 45% of companies pursuing this practice.

Companies increasingly see cross-functional collaboration as necessary to effectively meet the ESRS requirements. Among the respondents, EFRAG notes that typically five or more departments are regularly engaged in a company’s CSRD implementation process – commonly the sustainability and finance departments, risk management, human resources, and auditing or internal controls.

Of the undertakings, 95% are using EFRAG’s Implementation Guidance 3 – Datapoints to run their gap analysis, while a smaller number are using it as a preliminary base for the upcoming digital tagging requirement. Companies are encouraged to integrate their double materiality assessment outcomes in their gap analysis to avoid overinclusion and taking focus away from the relevant information that needs to be reported.

Approximately 90% of the undertakings have started improving data quality controls similar to those used for financial reporting, such as those recommended by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Many companies expect to rely on the phase-in period of required value chain information. Provided the use of phase-in periods is properly communicated, this can allow companies to spread out the burden of CSRD preparation. EFRAG, however, reports that 90% of the companies surveyed were refining their approach to mapping and analyzing their value chain, with about 45% having already adopted a more granular mapping of their value chain (i.e., going beyond the high-level upstream or downstream).

Related Contacts

This content is provided for general informational purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Cooley LLP, Cooley (UK) LLP, or any other affiliated practice or entity (collectively referred to as "Cooley"). By accessing this content, you agree that the information provided does not constitute legal or other professional advice. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction, and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Do not send any confidential information to Cooley, as we do not have any duty to keep any information you provide to us confidential. When advising companies, our attorney-client relationship is with the company, not with any individual. This content may have been generated with the assistance of artificial intelligence (Al) in accordance with our Al Principles, may be considered Attorney Advertising and is subject to our legal notices.