2022 – 2023 US Corporate Governance Survey: Part 1 Results

Cooley is committed to providing public companies and their boards with relevant, on-demand resources. As a part of that effort, we are excited to be conducting a multipart survey series designed to provide insights and best practices on key corporate governance topics, practices and market trends.

Here are the results and key takeaways from Part 1 of the survey series, which focused on shareholder engagement and annual meeting matters.

Shareholder engagement

Conducting shareholder outreach outside the annual meeting

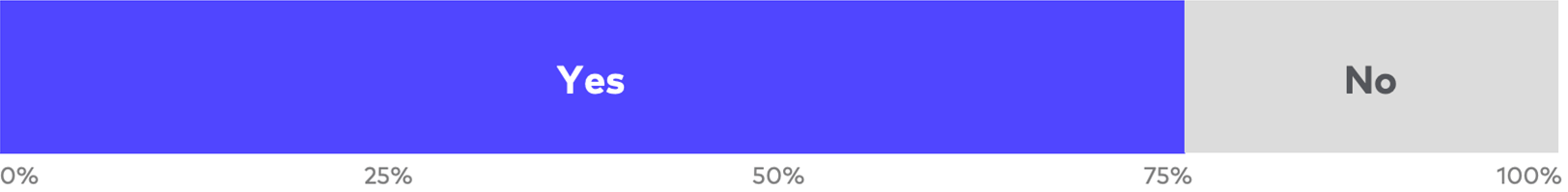

Just over three-quarters of respondents engage in proactive shareholder outreach outside the context of the annual shareholders meeting.

Retention of proxy solicitor for shareholder engagement

Of the companies that engage in shareholder outreach outside the context of the annual shareholders meeting, only about one-quarter regularly engage a proxy solicitor, while less than one-half engage a proxy solicitor even for unusual items.

While companies may engage in shareholder outreach as part of their annual meeting proxy solicitation process – whether because of a lower say-on-pay vote the prior year or a controversial management or shareholder proposal – more than three-quarters of respondents said they engage in proactive shareholder outreach outside the context of the annual meeting. According to the respondents, shareholder engagement occurs across a broad range of topics, including company-specific concerns (79%), executive compensation (38%), board composition (29%) and ESG matters (21%).

Annual meetings

Format of the most recent annual meeting

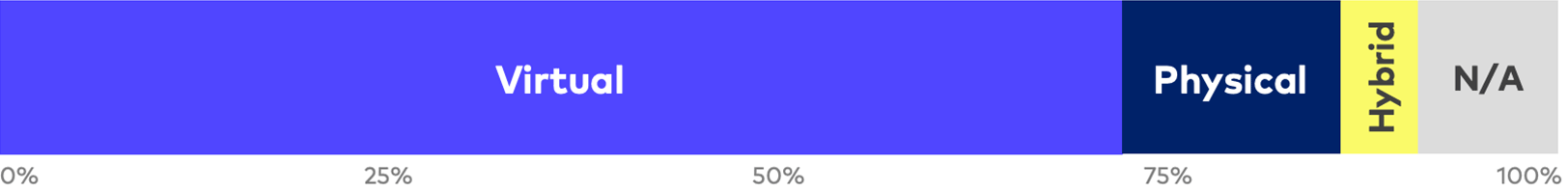

Nearly three-quarters of respondents held a virtual-only meeting for their most recent annual meeting, with a similar percentage planning to hold a virtual-only meeting this year.

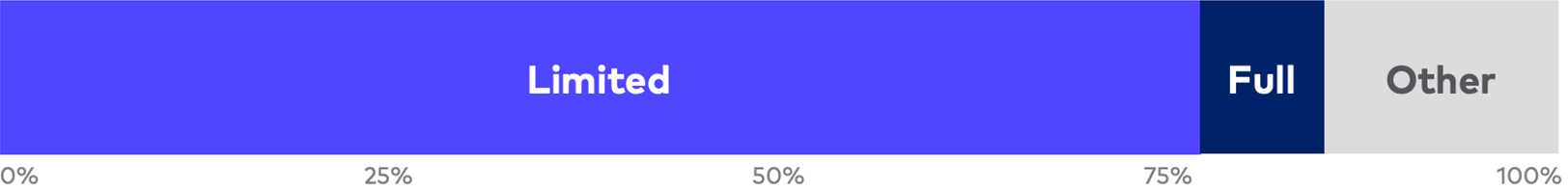

Approximately one-third of respondents did not have a management presentation or Q&A session during their most recent annual meeting, while about one-quarter of companies had a management presentation and an accompanying Q&A session. Nearly 10% of respondents had a management presentation but no Q&A session, with the remainder of respondents noting that none of these formats applied to them.

Q&A approach for companies that held a virtual-only meeting

Nearly 80% of respondents allow for submission of questions in writing during the meeting but only share and respond to selected questions, while 8% of respondents permit questions to be asked in writing or orally during the meeting, all of which are shared with the audience. For companies that selected “Other,” responses included permitting questions to be submitted during the meeting with responses by email or posted to the company’s website afterward, and allowing for questions to be submitted before and at the meeting, which could be answered at the company’s reasonable discretion.

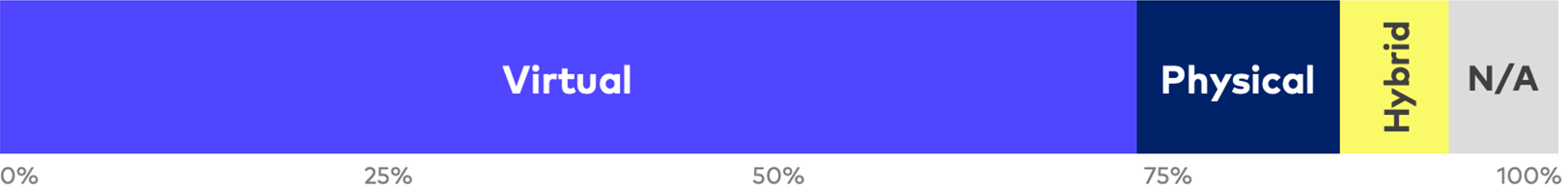

Upcoming annual meeting type

Nearly all companies that held virtual-only meetings for their most recent annual shareholders meeting plan to hold virtual-only meetings for their upcoming annual meeting this year, and all companies that held physical-only meetings plan to hold physical-only meetings this year. While the high number of virtual-only meetings continues, we will continue to monitor trends as pandemic-related restrictions lessen.

Future surveys

We invite you to participate in our upcoming surveys. They take less than five minutes to complete; responses will remain completely anonymous.

Join our list to receive updates when new content of interest to public company leaders is released. Subscribe